In the evolving landscape of finance, the demand for real-time market data is skyrocketing. Michael James, head of institutional business development at Douro Labs, emphasizes how high-speed oracle networks, particularly Pyth, are fundamentally transforming the $50 billion financial data sector. This transition is pivotal for exchanges, brokerages, trading firms, and various other institutional players who depend heavily on accurate pricing information.

During an insightful interview at Consensus 2025, James highlighted that the *Pyth Network’s innovative data pull model* distinguishes it from traditional pricing oracles. This model enables clients to pay for data on demand, thereby minimizing costs for organizations that rely on dynamic market data. Unlike traditional push models, which can be costly and inflexible, Pyth provides a cost-effective and responsive service that aligns with the real-time needs of traders.

According to James, the current financial data space is predominantly controlled by approximately eight major providers that arbitrarily inflate prices, leaving clients with little choice. He stated,

“These data vendors have no competition in traditional finance, and so they have all the pricing power in the world. There is no substitutability; whether you are a banker or hedge fund … you still have to buy that data for compliance reasons.”

The exorbitant costs associated with financial data are stifling innovation, particularly impacting small to medium-sized enterprises (SMEs). These high costs create barriers to entry, further constraining the market to a select few larger entities and hindering the exploration of new financial solutions.

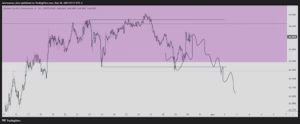

Pyth has made substantial strides in the realm of real-time market data and price feeds, encompassing a range of assets including cryptocurrencies, equities, foreign currency exchange markets (FOREX), commodities, and interest rates. Notably, in December 2024, Pyth launched its **real-time oil pricing data**, significantly impacting sectors such as energy trading. Tracking data from *West Texas Intermediate (WTI)* and *Brent Crude Oil*, this innovation equips the market with enhanced insights needed for effective decisions.

Throughout 2024, Pyth experienced a dramatic 46-fold increase in its total value secured (TVS), a critical metric reflecting capital safety within oracle networks. This rise suggests strong market confidence and an increasing trend towards decentralized finance solutions. Recent data indicates that Pyth commands approximately 11.3% of the blockchain oracle market, a noteworthy rise from 10.8% in September 2024.

As the financial data industry continues to evolve, the advent of high-speed oracle networks like Pyth serves to democratize access to vital data, equipping numerous businesses — both large and small — with the tools necessary for innovation. This transformation not only enhances operational efficiency but also paves the way for novel financial applications that could redefine the market landscape.