In recent weeks, the cryptocurrency market has been subjected to significant uncertainty and volatility, largely influenced by shifting global macroeconomic conditions. During this tumultuous period, Bitcoin’s price has fluctuated between $74,000 and $83,000, reflecting the intense reactions of investors to news events.

At the start of the week, Bitcoin’s value dipped to around $74,000 as panic swept through the cryptocurrency community following President Donald Trump’s announcement of new trade tariffs. However, on April 10, Bitcoin made a dramatic recovery, reclaiming a price above $83,000 after the president paused tariffs on countries other than China.

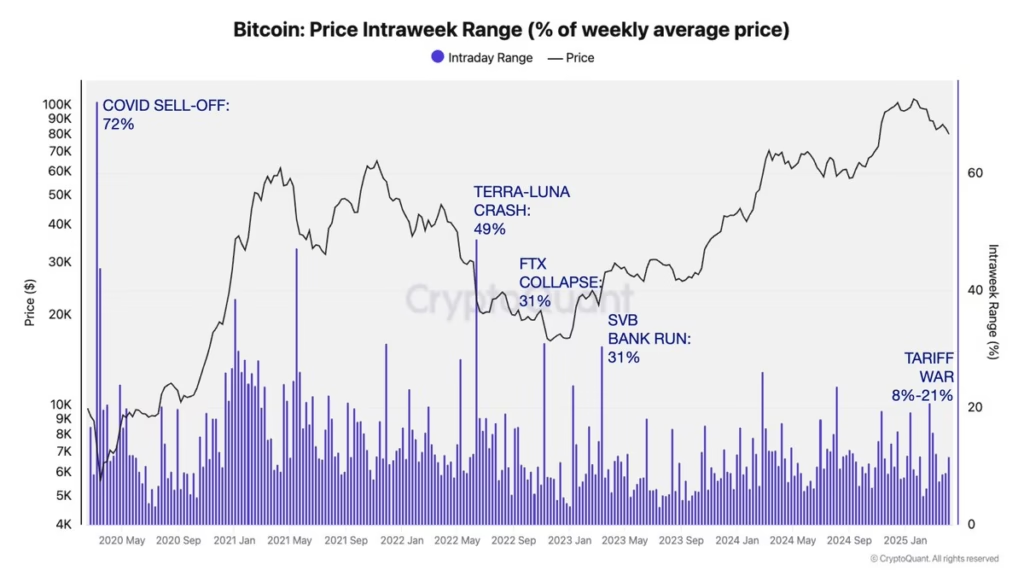

The heightened volatility experienced by Bitcoin in response to various news items underscores the current state of flux within the cryptocurrency market. Despite this, an insightful analysis from an on-chain analytics expert has revealed that the current volatility is comparatively lower than the extreme fluctuations witnessed during previous market events.

According to an analysis by CryptoQuant’s head of research, Julio Moreno, the Bitcoin Price Intraweek Range—a metric that measures the percentage change in the average weekly price—has shown significant moderation. During the COVID-19 market crash, the metric reached a staggering 72%, while it stood at 49% following the Terra-Luna crash in May 2022, and 31% in the aftermath of the FTX exchange collapse in late 2022.

Currently, with the ongoing trade tensions between the United States and China, the Bitcoin Price Intraweek Range is reported to be between 8% and 21%. This marked reduction in volatility suggests that Bitcoin is evolving as a more mature asset, with improved liquidity and market structure.

This stability in price movements can be attributed to a growing base of long-term holders and increased institutional acceptance. As Bitcoin garners more attention from larger corporate entities, it’s being perceived less as a high-risk investment and more as a potential hedge against macroeconomic uncertainties.

As of the latest updates, Bitcoin’s price is approximately $83,700, indicating a 5% increase over the past 24 hours. This upward trend reflects a positive sentiment among investors, despite the surrounding volatility.

In summary, while Bitcoin remains sensitive to global economic developments, the current atmosphere of reduced volatility indicates a maturation process. Investors are increasingly viewing Bitcoin not solely as a speculative asset but as a strategic component in managing financial risk amidst global uncertainties.