In the ever-evolving landscape of cryptocurrency, the Ethereum blockchain, long considered a premium network, is now facing significant changes as its transaction fees experience a steep decline. Recent reports have revealed that Ethereum’s transaction fees have fallen to their lowest level in over four years, raising questions about the future of the network and its broader implications for investors.

Total Transaction Fees At Their Lowest In Years

The Ethereum network has historically been known for its high gas fees, which have often deterred users. However, a recent report indicates that the overall activity on the network is slowing down, resulting in diminished demand for block space. This decline in activity is not just a market blip but suggests a larger momentum shift within the Ethereum ecosystem, which could impact decentralized finance (DeFi), non-fungible tokens (NFTs), and overall network engagement.

According to the latest statistics from a trusted market intelligence platform, Ethereum’s transaction fees plummeted approximately 60% in the first quarter of 2025, amounting to just $208 million by early April. This unprecedented fall coincides with an increase in Layer-2 solutions, particularly the rise of Base, which is now processing more than 80 transactions per second (TPS)

Market Trends and Weak Price Performance

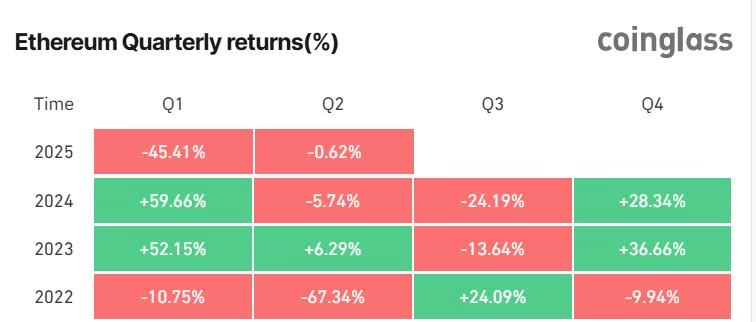

The drop in transaction fees is accompanied by a significant decline in Ethereum’s price, which has faced its worst quarterly performance in history. The altcoin’s value fell by around 45% in Q1 2025, reflecting a broader trend in the market where many investors are seeing diminished returns.

It is noteworthy that the ETH/BTC trading pair has also hit a five-year low, indicating weak performance. Despite these challenges, large-scale investors, often referred to as ‘whales’, appear undeterred, accumulating Ethereum below the $1,800 mark, signaling a possible rebound.

Insight from On-Chain Analysts

On-chain analysis offers further insights into the market dynamics at play. Analyzing average cost bases for ETH holders, it’s revealed that most holders currently have a realization price around $2,200. This suggests that many are experiencing losses, indicating a tough market environment for retail and small investors alike.

In contrast, the average cost basis for whales holding more than 100,000 ETH is significantly lower, sitting at around $1,290. Should Ethereum’s price fall below this critical support level, predictions indicate it may not drop below approximately $870, a level that has previously held firm during past market crises.

As volatility continues to dominate the cryptocurrency space, the coming weeks will be crucial in determining if Ethereum can regain its footing and overcome the challenges posed by low transaction fees and declining investor sentiment.