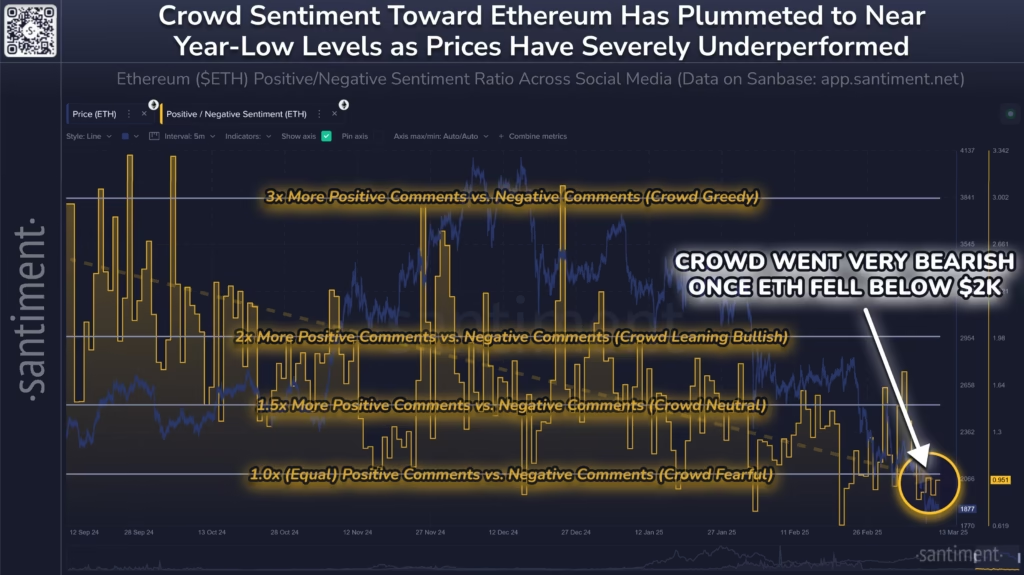

Recent trends show that sentiment around Ethereum (ETH) has rapidly declined on social media platforms, a development that may indicate a potential price reversal for the cryptocurrency. According to data analytics, the Positive/Negative Sentiment regarding Ethereum has turned bearish, especially following a notable price drop that saw the coin lose over 13% of its value in the last week alone.

The Positive/Negative Sentiment metric is crucial in understanding the mood of traders toward Ethereum. This metric aggregates comments, posts, and messages mentioning the asset across major social media. A machine-learning model evaluates these posts to classify them as either positive or negative. When the sentiment value exceeds 1, it indicates that optimistic posts dominate; conversely, a value beneath 1 signals a prevalent bearish sentiment.

As illustrated in the data, this sentiment indicator has dropped below the neutral mark of 1, reflecting a widespread belief among traders that Ethereum’s price will continue to decline. The trend follows a notable downtrend in Ethereum’s price, which recently fell below the $2,000 threshold.

Interestingly, historical patterns suggest that Ethereum’s price often moves counter to the prevailing social sentiment. In scenarios where fear and negativity dominate discussions, some analysts believe that this may pave the way for a market bottom, providing strategic buying opportunities for seasoned investors. The recent downturn has not only impacted Ethereum but has also aligned with similar trends observed across various digital assets.

While traders are revising their perspectives and exhibiting caution, it remains to be seen whether the current negative sentiment is sufficient to trigger a reversal. As the price hovers around $1,900, any shifts in social media sentiment might become pivotal in determining whether Ethereum can rebound from this bearish phase or if further sentiment decline is on the horizon.

- ETH Price Drop: Ethereum is currently facing a significant price drop, causing concerns among traders.

- Sentiment Analysis: A decline in social media sentiment could point towards a potential market bottom.

- Counter-Trend Observations: Historical trends show prices often move against social sentiment.

- Investor Strategies: Experienced stakeholders might find buying opportunities amidst widespread fear.

Ultimately, understanding these dynamics can be vital for any investor looking to make informed decisions in the fluctuating landscape of cryptocurrency.