Ethereum is back in the limelight as institutional demand and whale accumulation continue to shape its market landscape, even against the backdrop of a recent price correction. Despite some retracements causing uncertainty, the broader trend indicates that significant investors are consistently rotating capital into ETH. Recent headlines about whales moving substantial funds to accumulate Ethereum emphasize its role as a cornerstone asset for the next market phase.

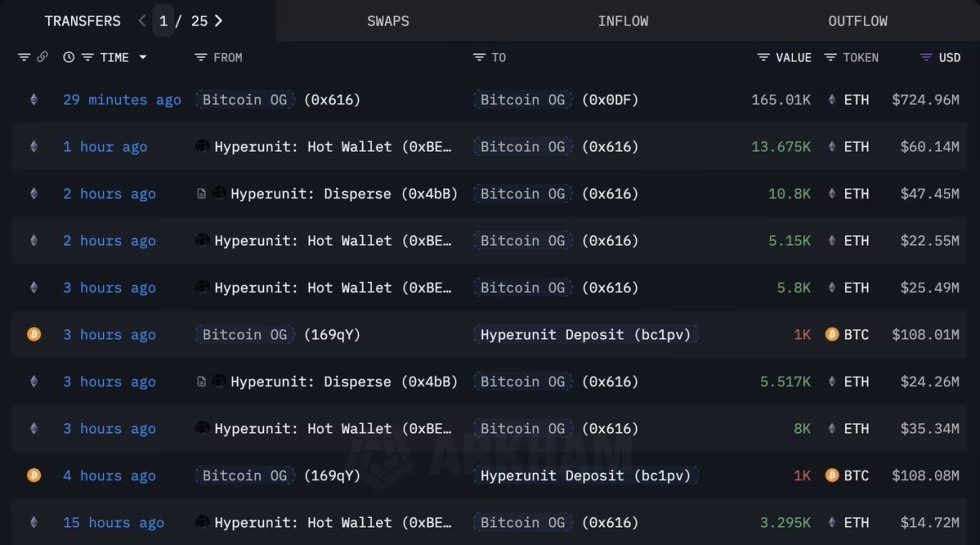

Among the influential players in this trend is a notable Bitcoin OG wallet that has captured analysts’ attention. Reports indicate that this whale has divested another 2,000 BTC, valued at approximately $215 million, only to funnel that capital into purchasing an impressive 48,942 ETH ($215 million) in a matter of hours. Such aggressive moves signal a clear transition strategy from Bitcoin to Ethereum among major investors.

According to blockchain data, this Bitcoin OG investor has amassed an astounding 886,371 ETH, worth roughly $4.07 billion. This massive accumulation has ignited intense speculation regarding Ethereum’s potential trajectory. Many analysts view this shift as a strong indication of smart money positioning, suggesting that whales are increasingly treating Ethereum as the premier alternative to Bitcoin in this capital rotation trend.

The sheer magnitude of these acquisitions implies that there is more at play than mere speculation. Large players are expressing robust confidence in Ethereum’s long-term prospects, particularly in its dominance in DeFi, stablecoins, and overall network activity. Additionally, by staking significant portions of their holdings, this whale demonstrates faith in Ethereum’s ability to yield returns while ensuring network security, highlighting its utility beyond mere price speculation.

Even with these bullish signals, risks loom on the horizon. Bitcoin has found it challenging to maintain its upward trajectory, and uncertainty around its recovery potential weighs on the broader crypto market. The struggle of several altcoins, which are encountering sharp corrections, further illustrates the fragile sentiment in the current phase.

As of now, Ethereum (ETH) is trading at around $4,414 after yet another unsuccessful attempt to breach the $4,500 resistance zone. The price action indicates that ETH has been stuck in a consolidation phase, forming a sideways range since mid-August. Although recent volatility has been evident, ETH has managed to remain above the critical 200-day SMA near $4,220, attracting buyers during dips.

The 50-day and 100-day SMAs are clustered around $4,460, serving as resistance that has capped potential upward momentum. Rejections from this zone have highlighted hesitance in the market as traders await clearer direction. If ETH can maintain its position above $4,400, it creates potential for a push back towards $4,600 to $4,800. Conversely, a fall below $4,300 might lead to further decline toward the $4,200 support area.

Recent momentum indicators suggest a cooling phase following Ethereum’s strong rally in July and early August. The price compression currently observed signals that market participants are gearing up for significant moves ahead. On a fundamental level, on-chain data revealing whale accumulation coupled with dwindling exchange reserves bolsters a longer-term bullish outlook for Ethereum.