Ethereum, often regarded as the “king of altcoins,” has experienced a tumultuous journey since the start of 2025, recently falling below the crucial $2,000 mark. However, recent on-chain data may suggest a shift in momentum for Ethereum’s price action, indicating potential recovery ahead.

Why Ethereum’s Price Could Rebound

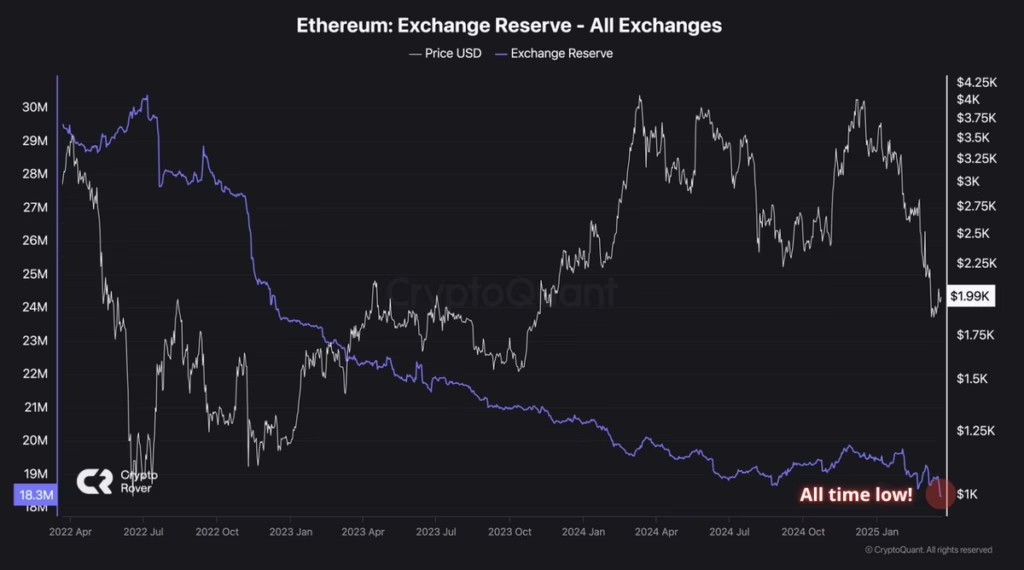

Insights from a well-known cryptocurrency analyst reveal significant outflows of Ethereum from centralized exchanges. This observation stems from the Ethereum Exchange Reserve metric, which quantifies the total amount of ETH held on centralized platforms. When this value decreases, it often reflects bullish sentiments as investors shift assets to personal wallets, suggesting increased confidence in Ethereum’s future.

Recent data indicates that Ethereum whales, those holding substantial amounts of ETH, have been acquiring more tokens. Notably, over 120,000 ETH tokens have been purchased by these whales in the last 72 hours, signifying growing institutional interest and potential market stability.

Moreover, the Ethereum Exchange Reserve has dropped to an all-time low of 18.3 million ETH tokens. This sharp decline can be interpreted as a positive signal for the cryptocurrency’s price. The trend indicates that more holders are opting to keep their assets secure in self-custodial wallets rather than on exchanges. Such a move demonstrates long-term confidence in Ethereum’s potential, given the reduced availability of the token for trading.

Understanding the Supply Dynamics

The current market scenario raises the possibility of a “supply shock” for Ethereum. This term refers to a scenario where the available supply of an asset declines significantly, which historically has led to price hikes. If Ethereum’s reserves on centralized platforms continue to decrease, we may witness a substantial shift in market dynamics, potentially leading to a price rebound.

Ethereum’s Current Price Snapshot

As of now, Ethereum’s price is hovering around $1,990, showing a modest increase of 0.6% over the past 24 hours. While still below the critical $2,000 threshold, the signs stemming from on-chain data and whale activity could pave the way for a significant recovery.

In conclusion, the current decrease in Ethereum’s exchange reserves, coupled with increasing whale purchases, hints at a market gearing up for potential growth. Investors may find it prudent to keep an eye on these fluctuations, as they could signal a favorable shift in Ethereum’s price trajectory.