In a surprising turn of events, Ethereum futures volume has significantly outpaced that of Bitcoin, indicating a robust interest from speculators entering the cryptocurrency market. According to analytical data, this shift not only reflects increased trading but also emphasizes the evolving landscape of digital assets.

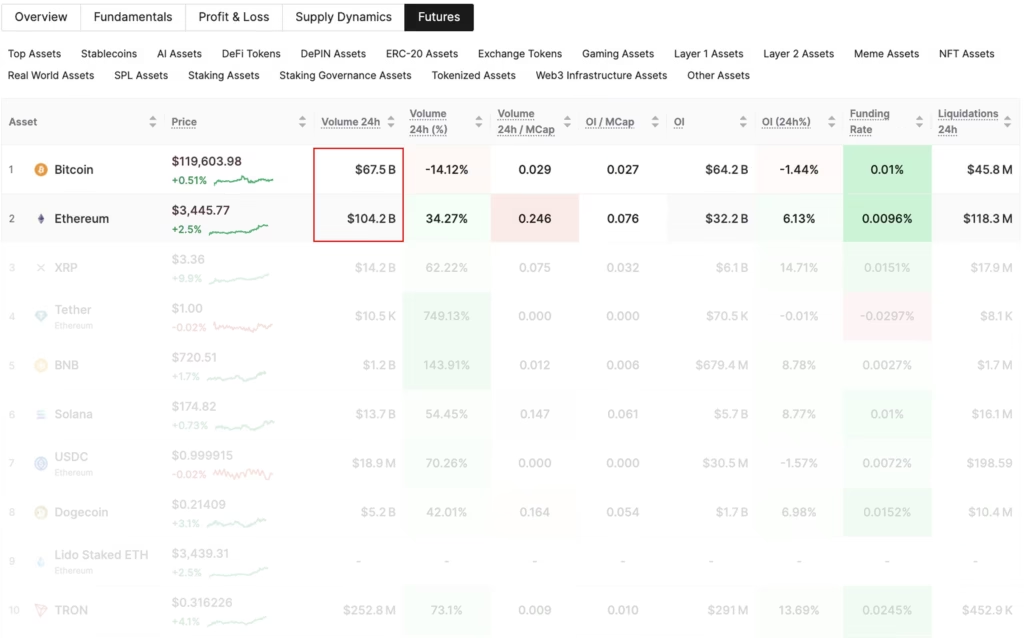

Recent figures highlight that Ethereum’s trading volume reached an impressive $104.2 billion compared to Bitcoin’s $67.5 billion. This change is noteworthy as Bitcoin, traditionally regarded as the leading cryptocurrency, often sees higher speculative demand than altcoins like Ethereum. The surge in Ethereum’s trading activity signals a new chapter for investors looking for opportunities in the crypto market.

- Ethereum Futures Volume: $104.2 billion

- Bitcoin Futures Volume: $67.5 billion

Open Interest, a crucial metric reflecting the total number of open futures positions across derivatives platforms, further delineates the current market dynamics. Data reveals that Bitcoin’s Open Interest stands at $64.2 billion, while Ethereum’s is at $32.2 billion. Despite having a lower Open Interest, Ethereum shows a positive 6.1% increase, while Bitcoin has dropped by 1.4%. This disparity may suggest that, despite a lower positioning in the overall market, Ethereum is beginning to capture speculative interest among traders.

Accompanying the trading volume surge, Ethereum’s price has surged to approximately $3,600, marking a notable 21% increase over the past week. This rally has been attributed to a wave of new inflows into spot exchange-traded funds (ETFs), which have drawn considerable attention to Ethereum. However, the average Funding Rate, a measure of the periodic fees exchanged between futures traders, remains relatively moderate for Ethereum at 0.0096%. This figure is slightly less than Bitcoin’s rate of 0.01%, indicating that investor optimism, while present, may not be entirely bullish.

What Lies Ahead for Ethereum?

As we analyze these trends, it becomes clear that the current setup leans bullish: increased speculative interest, rising Open Interest, and no signs of market overheating at present. Investors should remain attentive to these developments, as Ethereum seems poised to establish itself further in the futures market. Monitoring the interaction between trading volumes and price movements will be crucial for forecasting future opportunities arising in this volatile landscape of digital assets.