Bitcoin has recently surged by 9% since last Sunday, indicating a renewed strength in its movement as it approaches critical resistance levels. After a period of uncertain price fluctuations, momentum appears to be building within the crypto market. Traders and analysts are now meticulously observing Bitcoin’s next moves, with many expecting a potential breakout above the all-time high of $112,000.

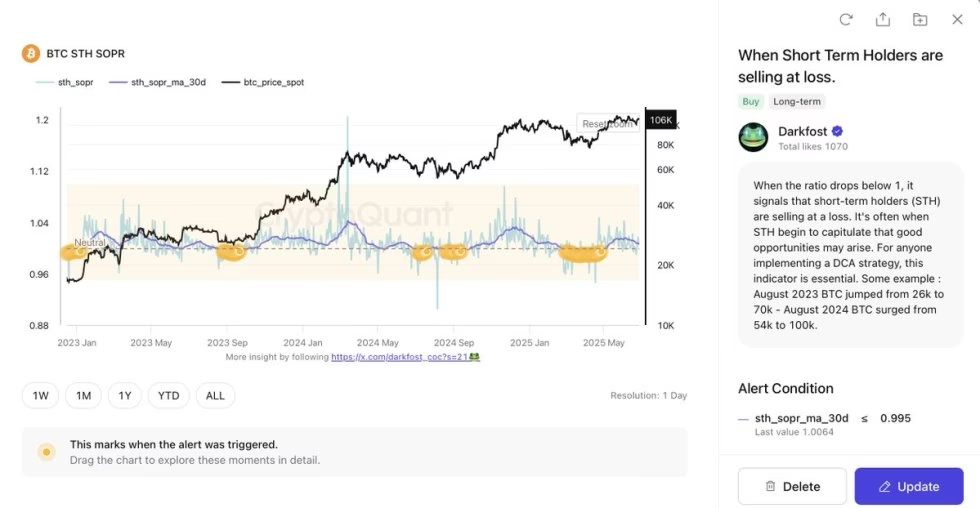

The positive outlook is further bolstered by a significant on-chain signal that highlights the short-term holder (STH) realized price ratio recently dropping below 0.995. This threshold historically indicates that short-term holders are capitulating, often selling at a loss, which tends to occur at local bottoms. Such behavior can present high-reward opportunities for long-term investors, as these moments of perceived weakness often precede strong recoveries and upward trends.

As the price of Bitcoin increases, broader market sentiment remains optimistic. Many believe that if Bitcoin can achieve a confirmed breakout, it may stimulate momentum across the altcoin sector as well. The ongoing focus is on whether Bitcoin can sustain its current gains and decisively cross resistance levels. With strong fundamentals and rising institutional interest, alongside supportive on-chain data, Bitcoin’s next major move could be imminent.

Currently, Bitcoin is trading at approximately $107,321, consolidating just beneath the pivotal resistance level of $109,300. This price zone has acted as a significant ceiling for more than a month, with numerous attempts to break above it proving unsuccessful. The latest recovery from the key support level of $103,600 shows strength, as Bitcoin has reclaimed all key moving averages: the 50 SMA ($105,774), 100 SMA ($105,866), and is trading well above the 200 SMA ($97,046). This indicates a promising shift in short-term momentum favoring bullish traders.

Analysis from the 12-hour chart reveals a distinct pattern of higher lows, signaling that buyers are stepping in with growing confidence. However, the recent lack of trading volume suggests some hesitation among traders awaiting a confirmed breakout before fully committing to buy positions. For Bitcoin to experience significant upside movement, it must consistently close above $109,300, thereby turning this resistance into support.

Should the bulls fail to break above this level shortly, attention will turn to the critical support range between $105,000 and $103,600. A breakdown below this range could lead to a more profound retracement towards the 200 SMA near $97,000. Until then, Bitcoin holds a neutral-to-bullish stance as the market keeps a close watch for a decisive movement that may define the impending phase of this market cycle.