Bitcoin has recently experienced a seismic shift in its market landscape, with open interest dropping by nearly 20%, leading to a staggering wipeout of approximately $12 billion. Many investors may view this decline as a cautionary sign, yet analysts like CryptoQuant’s DarkFost argue that this event could be pivotal for Bitcoin’s future trajectory.

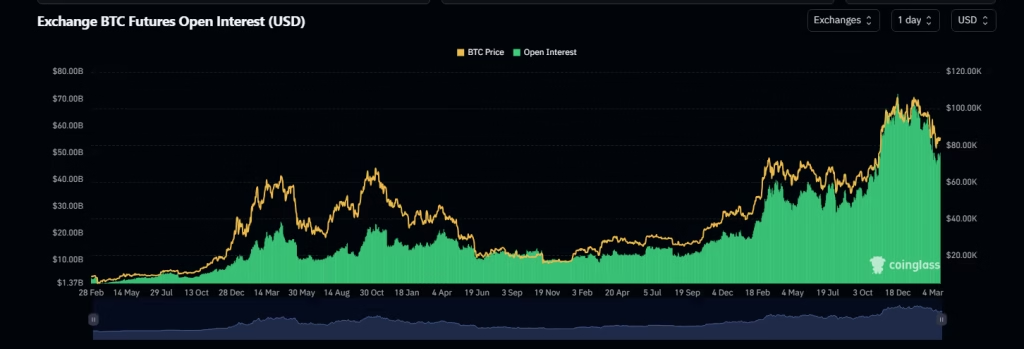

According to data from CoinGlass, Bitcoin’s open interest fell from $61.42 billion to $49.71 billion. This significant decline, triggered by panic related to political instability and decisions made by former President Donald Trump, has led to a mass liquidation of leveraged positions. DarkFost believes this may actually present opportunities for investors if historical patterns hold true.

The likeliness of Bitcoin regaining its upward momentum hinges on this ‘shakeout,’ which could serve as a natural market reset. DarkFost claims that this phase is essential for a bullish continuation. He noted that more than $10 billion in open interest has been eradicated over the last two months, particularly between February 20 and March 4.

“This is a necessary process to clear out excess and allow for subsequent growth,” he stated, emphasizing the importance of observing historical trends, which indicate that such deleveraging often provides favorable conditions for the short to medium term.

With Bitcoin currently hovering around the $80,000 mark, DarkFost suggests that the recent ordeal could yield positive outcomes in the coming months. He shared a comprehensive chart demonstrating the reset phases based on the 90-day open interest changes, which currently sits at -14%, further solidifying the notion that now may be an opportune moment for investors to enter the market.

The Federal Reserve’s upcoming decisions may also play a crucial role in Bitcoin’s market dynamics. The March 19 meeting of the Federal Open Market Committee is highly anticipated, as any unexpected news regarding interest rates could amplify volatility in the cryptocurrency market. As noted by Bitget chief analyst Ryan Lee, while many expect the Fed to keep rates steady, hints of hawkishness could add pressure on both Bitcoin and other risk assets.

“We may see increased fluctuations in Bitcoin’s price and open interest as the market reacts to new policy changes,” Lee warns.

As of this moment, Bitcoin’s open interest stands at $49.02 billion, reflecting a 6.5% increase over the past five days. This trend highlights the dynamic nature of the crypto market, and investors would do well to remain vigilant.