In recent days, Bitcoin has faced significant volatility, primarily influenced by shifting geopolitical tensions in the Middle East. Over the weekend, BTC fell below the crucial psychological threshold of $100,000 following reports of US military strikes on Iranian nuclear facilities, causing panic among investors. However, the mood quickly shifted when a ceasefire agreement between Israel and Iran was announced, leading to a robust rally that saw Bitcoin surge back above $105,000. This highlights the market’s acute sensitivity to global conflict headlines.

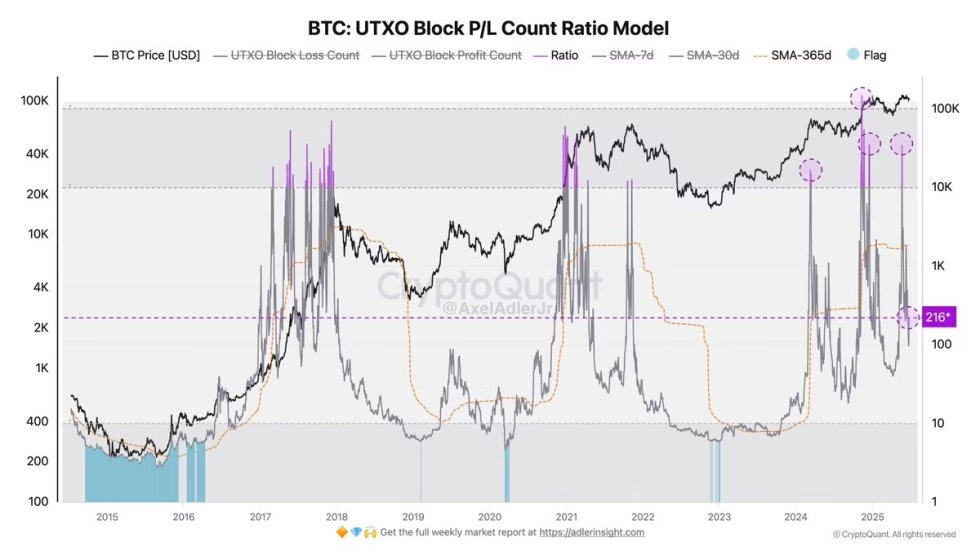

Data from the UTXO Block P/L Count Ratio Model by CryptoQuant sheds light on investor behavior amidst this recovery. At the peak of $112,000 earlier this month, the model recorded a spike to 34,000 points, indicating a wave of profit-taking where holders sold into strength. However, this metric has since plummeted to just 216 points, suggesting that profitable selling has virtually vanished, with a growing portion of transactions now being realized at a loss. This shift indicates that sellers have largely stepped aside, allowing buyers to gain traction at these lower price levels.

Currently, Bitcoin finds itself at a pivotal juncture, having surged over 7% in less than 25 hours, reclaiming higher price levels above $105,000. Despite this bullish bounce igniting renewed investor optimism, Bitcoin remains entrenched within the consolidation range that has characterized price action since May. Short-term directional clarity remains clouded by ongoing global tensions and tightening macroeconomic conditions, which continue to inject volatility into the market.

Top analyst Axel Adler has shared insights indicating a palpable shift in investor behavior. When Bitcoin hit its all-time high of $112,000 earlier this month, the UTXO model registered a spike reflecting the profit-taking wave. Yet, as the metric has dramatically decreased to 216 points, it signals that sellers have exited the market, creating a conducive environment for new buyers to establish positions at lower levels. While downside risks linger, the diminished selling pressure and resurgence of long-term conviction are paving the way for Bitcoin’s potential recovery.

The daily Bitcoin chart indicates a dramatic bounce from a low of $98,200 toward the $105,000 region, effectively reclaiming a critical support zone near $103,600. This area has historically acted as both support and resistance since March, making it a pivotal battleground for bulls. Although the price briefly dipped below the 50-day simple moving average (SMA), it quickly recovered above it, signaling renewed short-term strength.

Despite the positive momentum, Bitcoin has yet to breach the crucial resistance level at $109,300, which has capped multiple rallies since early June. A spike in volume on the recent green candle suggests that demand is returning at these lower levels, lending credence to on-chain data indicating sellers are retreating. Nonetheless, without breaking above $109,300, Bitcoin risks remaining in broad consolidation.

To initiate a genuine trend reversal and regain momentum towards previous all-time highs, closing decisively above $109,300 is essential. Traders should prepare for continued market fluctuations as macro uncertainty and geopolitical events influence short-term sentiment.