Bitcoin’s price has faced a notable decline, slipping below $102,000 on Thursday as traders reacted to profit-taking after a remarkable rally. Currently trading at $102,716, Bitcoin (BTC) is down by 3.35% from its highest price this year. This recent downturn has reverberated through the altcoin market, causing larger sell-offs in cryptocurrencies like Ethereum (ETH), Solana (SOL), and Polkadot (DOT).

The cause of the current price drop remains ambiguous, with no specific triggering events identified. However, it appears traders are consolidating their gains after Bitcoin’s over 40% rally from the lows set in April. The performance of Bitcoin mirrors the broader stock market trends, as major stock indices, including the Dow Jones, Nasdaq 100, and S&P 500, have all recorded declines of more than 0.50%.

Despite the price retreat, the fundamental outlook for Bitcoin remains robust. Demand for Bitcoin is on the rise, propelled by significant inflows into spot Bitcoin ETFs, which saw over $319 million in inflows just this Wednesday. This has elevated the total inflow figure since inception to an impressive $41.40 billion. Furthermore, Bitcoin’s mining difficulty and hash rate continue on an upward trend, while the available supply on exchanges has plummeted to its lowest level in over six years.

Analysts at crypto.news noted a bullish trajectory in Bitcoin’s price chart, highlighting the emergence of a cup-and-handle pattern. This pattern suggests potential further gains in the coming months, with Bitcoin consistently holding above the crucial 50-week Exponential Moving Average since October 2023. Furthermore, Bitcoin has drawn the attention of institutional players, with entities like Michael Saylor continuing to accumulate Bitcoin in a strategic manner.

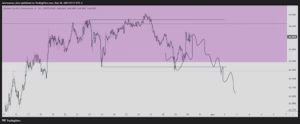

The price charts indicate that Bitcoin is forming a giant megaphone pattern, which typically precedes strong bullish movements in the market. A confirmed rally is expected if the price breaks above its all-time high of $109,300, after which traders will be eyeing the psychological resistance level at $110,000 followed by $115,000. However, this bullish outlook could be invalidated if the price were to drop below the lower boundary of the megaphone. As the market evolves, investors will be keenly watching for signs of a significant breakout.