In a vibrant week for the cryptocurrency market, Michael Saylor, founder of MicroStrategy, dismissed the possibility of Bitcoin retracing to $60,000. Instead, he confidently projected a future rise, hinting at his $100,000 celebration planned for New Year’s Eve. Currently, Bitcoin is trading around $87,790, with Saylor excited about its upward trajectory amidst improving market sentiment.

During an interview with CNBC, Saylor emphasized, “I don’t think it is going to $60,000, it is not going to $30,000, I think it is going to go up from here,” sharing his optimism concerning the impact of recent political shifts. He noted that Donald Trump’s return to the presidency has notably settled the future of crypto in the United States, stating that there are no immediate threats to Bitcoin’s price.

In another significant development, the U.S. Commodity Futures Trading Commission (CFTC) issued a notice that paves the way for much-anticipated Bitcoin ETF options. This advancement signals a likely boost for Bitcoin’s price as traders and investors anticipate increased adoption and liquidity. As analyst Eric Balchunas remarked, “Ball now in OCC’s court, and they are into it, so they’ll probably list very soon.” The approval of ETF options is primed to have a growing influence on the market exchange dynamics.

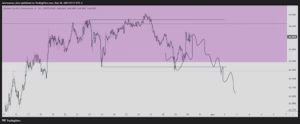

Additionally, firms like VanEck are projecting significant price movements, estimating that Bitcoin could soar to $180,000 by next year. Matthew Sigel, head of digital assets research at VanEck, stated, “We’re now in blue-sky territory, no technical resistance,” reflecting the bullish sentiments circulating among major investment firms. After Bitcoin’s rise of about 30% since early November, many are eagerly watching the market to see if it can sustain momentum towards potential all-time highs.

As the week concludes, Bitcoin sits at $91,274, along with Ethereum (ETH) at $3,097 and XRP at $0.90. The total cryptocurrency market capitalization has surged to $3.02 trillion, highlighting the strong bullish signals driving traders and investors alike.