Retail traders are urged to proceed with caution following the remarkable rise of Mantra (OM), which recently reached an all-time high (ATH) of $3.42. This achievement came about as the broader cryptocurrency market experienced slight declines. Over the past week alone, Mantra saw an impressive 137% increase, with a 43% surge in just the last 24 hours.

Originally posting at as of the time of writing, Mantra has secured its position as the 38th leading cryptocurrency with a substantial market cap of $2.85 billion. Such impressive figures often attract attention but also come with their own set of risks.

One of the key drivers for this price increase has been the significant partnership made with Google Cloud in late October. This collaboration has drawn in an influx of investments from larger holders, or whales, contributing to a thriving and bullish sentiment surrounding the token.

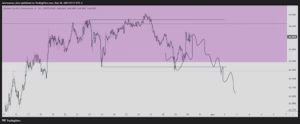

However, it is important to note that whale profit-taking could signal a correction. Recent data indicates that large holder net inflows have decreased considerably, plummeting from 2.96 million OM on November 14 to 1.8 million OM as of Saturday. Observations suggest that a large percentage—over 94%—of Mantra’s circulating supply is held in whale wallets. Consequently, the onset of profit-taking could potentially trigger a significant selloff in the market.

Moreover, with more than 24% of Mantra addresses holding their assets for less than a month, and 43%% holding for under a year, the risk of short-term traders opting to take profits is tangible. This factor is particularly concerning for the 6% of retail holders who may impulsively liquidate their positions following the recent surge.

In summary, while Mantra’s impressive gains showcase the potential rewards in cryptocurrency trading, the current market signals suggest a precarious situation for retail traders. It is essential to stay informed and consider the possibility of price corrections before making investment decisions.