Bitcoin Open Interest Hits 1-Year High as Price Surges Towards $68K

Demand for leverage in BTC futures jumped to $38 billion, but traders appear well-positioned enough to avoid surprise price swings.

Bitcoin price gained 8% between Oct. 14 and 15, up 11.5% over the past 30 days, significantly outperforming the S&P 500.

The aggregate Bitcoin futures open interest signals a rising appetite for leverage, causing unease among investors.

Increased Volatility and Demand

Data shows that the total number of Bitcoin futures contracts reached 566,270 on Oct. 15, the highest level since January 2023.

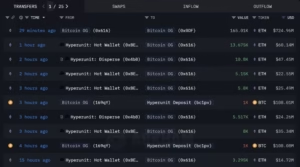

Recent net inflows into US-listed Bitcoin spot ETFs further fueled bullish sentiment, signaling increased institutional interest.

Market Structure and Leverage

The Bitcoin futures premium reached 10% in the early hours of Oct. 15, indicating demand from leveraged longs, but the market structure remains balanced.

Despite the surge in leverage use, traders are exercising restraint, reducing the likelihood of cascading liquidations.

Disclaimer: This article is for general information purposes and not investment advice.