Chainlink (LINK) has faced significant market challenges, shedding over 33% of its value since reaching local highs in May. The combination of escalating geopolitical tensions in the Middle East and increasing macroeconomic uncertainties—those driven by rising US Treasury yields and a cautious Federal Reserve—has eroded investor confidence across cryptocurrency markets. Thus, the overall trend for LINK is under pressure, as bulls seem to have lost control, prompting an urgent search for solid support.

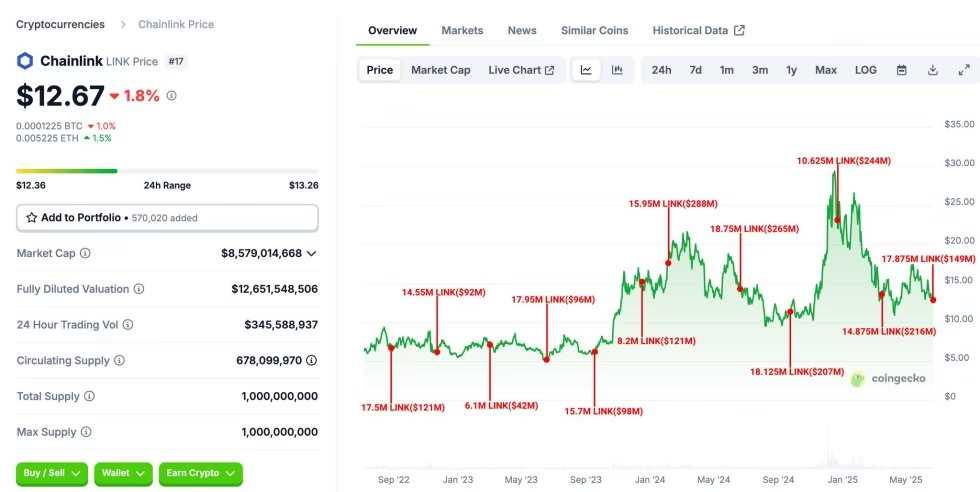

On-chain data from Lookonchain reveals a concerning development: non-circulating supply wallets have deposited a staggering 17.875 million LINK—valued at around $149 million—into Binance. Such a significant inflow to a centralized exchange raises alarms about potential selling activities, further contributing to the fragile sentiment surrounding LINK. Historically, Chainlink’s unlock events have often led to volatile price fluctuations; while some occasions have seen subsequent price rallies, the current market conditions cast doubt on the prospect of a similar response.

The ongoing market environment is being closely monitored as LINK encounters critical support levels. The coin battles both technical vulnerabilities and a turbulent macroeconomic backdrop. The future trajectory of LINK will likely depend on whether accumulation resumes or if downside pressure intensifies, hinging on how global risk appetite and on-chain patterns evolve in the coming days.

Despite Chainlink’s struggles, the platform continues to demonstrate fundamental strength through significant partnerships and consistent developments. The long-term outlook for LINK remains promising, particularly as adoption increases across traditional finance and Web3 infrastructure. However, short-term price performance tells a contrasting tale. Since peaking in May, LINK has seen a sharp retracement, currently positioned to defend its existing levels to stave off a more severe correction.

In the context of escalating conflicts and tightening financial parameters, many altcoins have lost ground against Bitcoin. Chainlink has not escaped this trend, with Bitcoin dominance now hitting new highs and siphoning capital away from smaller-cap assets. Therefore, LINK bulls find themselves under increased pressure to safeguard crucial support areas to prevent further momentum erosion.

Investors remain anxious as Lookonchain highlights substantial LINK movements from non-circulating wallets to Binance. Such transfers raise concerns about potential selling activity, though historical trends offer some cause for optimism. Chainlink’s past unlocks have generally been followed by price recoveries as market liquidity improves and demand rebounds. Nevertheless, the current macroeconomic environment, combined with the surge in Bitcoin dominance and the underperformance of altcoins, may delay any potential recovery for LINK.

Currently trading around $11.98, Chainlink has recently slipped below crucial support zones that previously held firm throughout Q2 2025. The daily chart starkly illustrates a continuous downtrend initiated in mid-May, characterized by an array of lower highs and lower lows. As of now, LINK has lost over 33% of its value since its May peak of approximately $18. The latest price action further confirms a breakdown below the psychological $12 level.

Adding to the bearish outlook, the 50-day, 100-day, and 200-day simple moving averages (SMAs) all reside above the current price, underscoring a strong bearish momentum. A recent cross of the 50-day SMA below the 100-day SMA has reinforced short-term weakness for the asset. Moreover, LINK is trading at levels not witnessed since early November 2024, exposing the asset to additional downside risk if robust demand does not materialize soon.